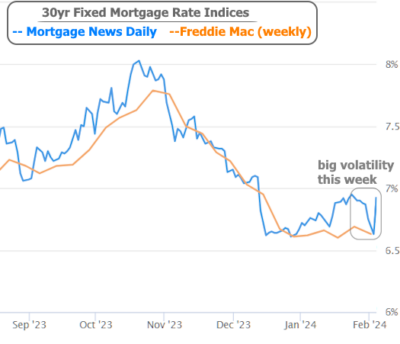

Interest rates often react strongly to the jobs report, more than any other monthly economic data. Recently, mortgage rates surged at the fastest pace in over a year due to the jobs report showing stronger-than-expected nonfarm payrolls (NFP).

When the labor market is robust, interest rates tend to go up. This time, the NFP numbers were significantly higher than the forecast, leading to speculation about manipulation or incompetence. However, savvy market participants understand that January’s job data can deviate widely from expectations due to the Bureau of Labor Statistics (BLS) implementing new benchmarks based on a comprehensive count of jobs from the previous March.

The BLS benchmark revision process is complex and often misunderstood, leading to conspiracy theories. It adjusts job counts based on changing labor market compositions, which can result in major deviations when revisions are implemented in January data.

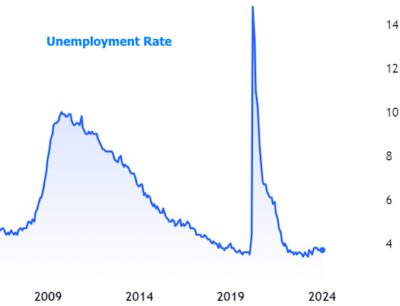

While benchmark revisions don’t fully explain the recent volatile results, they help the financial market take the numbers with caution. Looking at unemployment rates provides another perspective, showing less shocking figures.

The bond market, which determines rates, experienced unexpected drops earlier in the week, making Friday’s rate increase more pronounced. The week saw the biggest drop in mortgage rates in over a month, and Friday’s rates were in line with the previous week’s highest rates.

The week’s volatility also involved complex factors related to the mortgage-backed securities market. Despite these confusing elements, it took a combination of factors to cause such a significant rate jump.

Instead of dwelling on the recent past, it’s essential to consider the near-term future. A strong labor market alone cannot sustain higher rates if inflation continues to decrease. The Federal Reserve, led by Chair Powell, expressed confidence in inflation trends but emphasized the need for more certainty.

While strong labor market data raises doubts about rate cuts, upcoming inflation reports could influence financial markets. If core inflation moves closer to the 2% target, markets may position for lower rates even before an official Fed cut.

The next major inflation report is two weeks away, so investors will focus on other economic data, Fed speakers’ comments, and the Treasury auction cycle in the meantime.